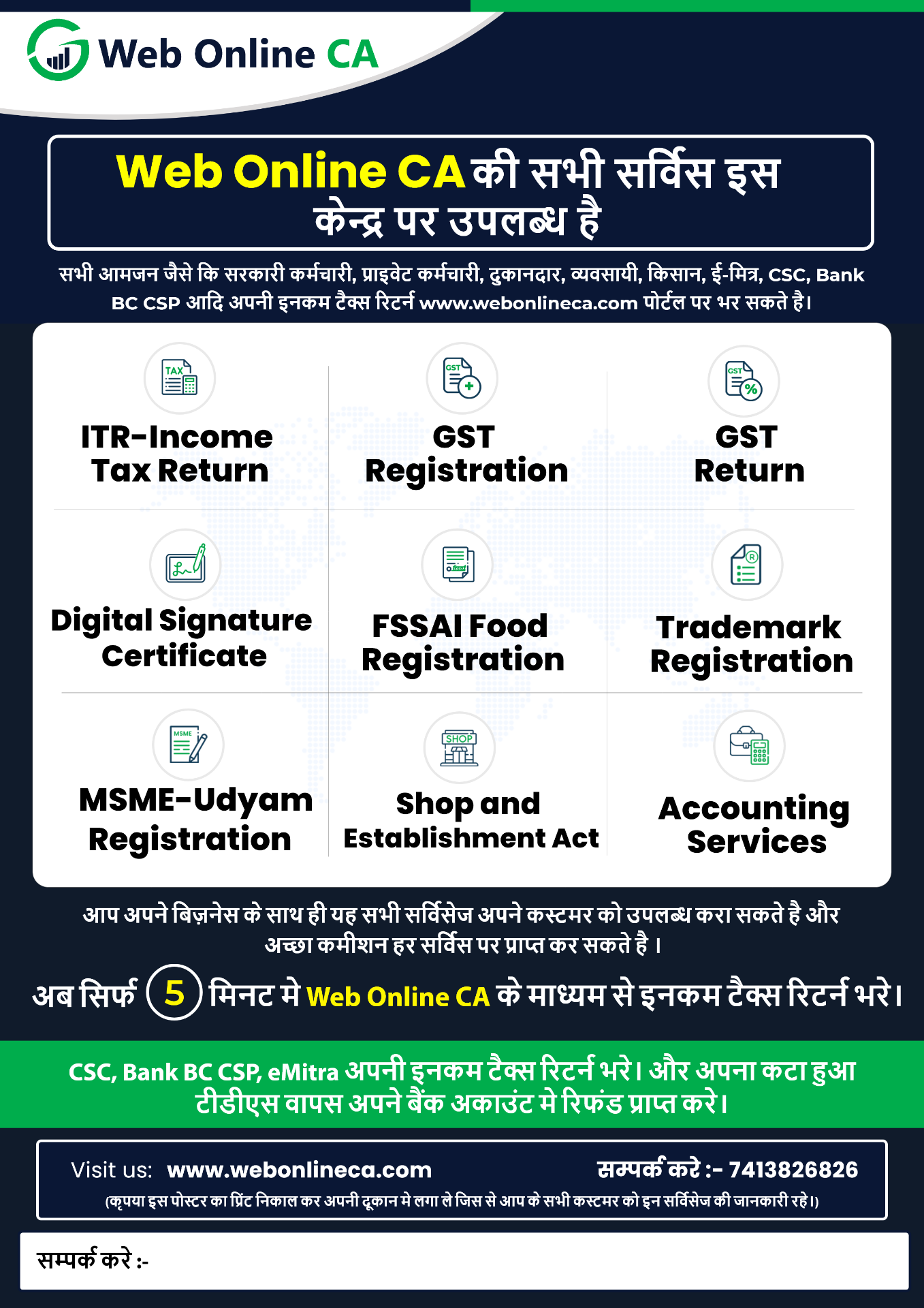

Importance Of Getting Registered For GST

A taxpayer's

gst registration Online is as necessary for

accessing government benefits, and legal recognition as a citizen's identity

document is for entering the nation. Severe penalties, such as paying 10% of

the tax evaded, or Rs.10,000, whichever is more, may result from failing to

register for GST. If someone knowingly fails to write and is later discovered

to be a fraud, they could face a fine of up to one hundred percent of the taxes

they could not pay.

For applying new gst registration, you can search

how to get new gst registration onlineat gst registration portal.

To sum up the importance of GST Registration

:Credibility

Consumers and vendors are likelier to do business with a verified

individual or legitimate company. Having this trait demonstrates that you are

reliable. Having all the necessary paperwork and fully complying with the rules

and regulations gives off a fantastic first impression, whether you're a

business or an individual. It's useful for establishing trustworthy connections

with vendors and customers.

Benefit Of ITC

When doing business with GST-registered people or organizations,

suppliers can claim Input Tax Credit (ITC). If you are GST-registered,

suppliers are likelier to do business with you than those who are not.

Preventing Pointless Obstacles

If you need to

online gst registration, you can avoid problems.

In the Goods and Services Tax regime, transactions occur successively. Every

step of the product's journey can be traced from the factory to the supplier to

the wholesaler to the retailer to the consumer. Everyone in this chain would

want to stay GST-compliant to avoid any problems.

Legal Strength

If a company or an individual sues you for whatever reason, you will

have the backing of the law if you are GST registered. You must write for GST

to prove that your company is real.

Avoid Penalties

According to section 122 of the CGST Act, the penalty for a taxable

business or individual who voluntarily chooses not to register under GST is the

greater of Rs. 10,000 or the amount corresponding to the tax evaded or the tax

liability. This makes the authorities suspicious of your reliability and may

lead to increased monitoring or other unwelcome consequences.

Potential for Losses

If you are not GST registered, the authorities can seize your goods. If

a taxable business or individual isn't GST-registered, Section 130 of the

CGST/SGST Act allows merchandise to be captured. Damage to confiscated items

increases the potential loss for a business that has to pay to replace them.

Products may be wasted, or the delay in seizing them may be too long. You must

fix your confiscation difficulties before you can make or supply items. A major

financial setback may result from this.

Business Shutdown

Without

gst registration apply online, your firm is likely to

have its goods confiscated or have significant penalties imposed on it. Because

it's not always possible to get back the goods that have been seized, penalties

imposed could even outweigh earnings in some cases.

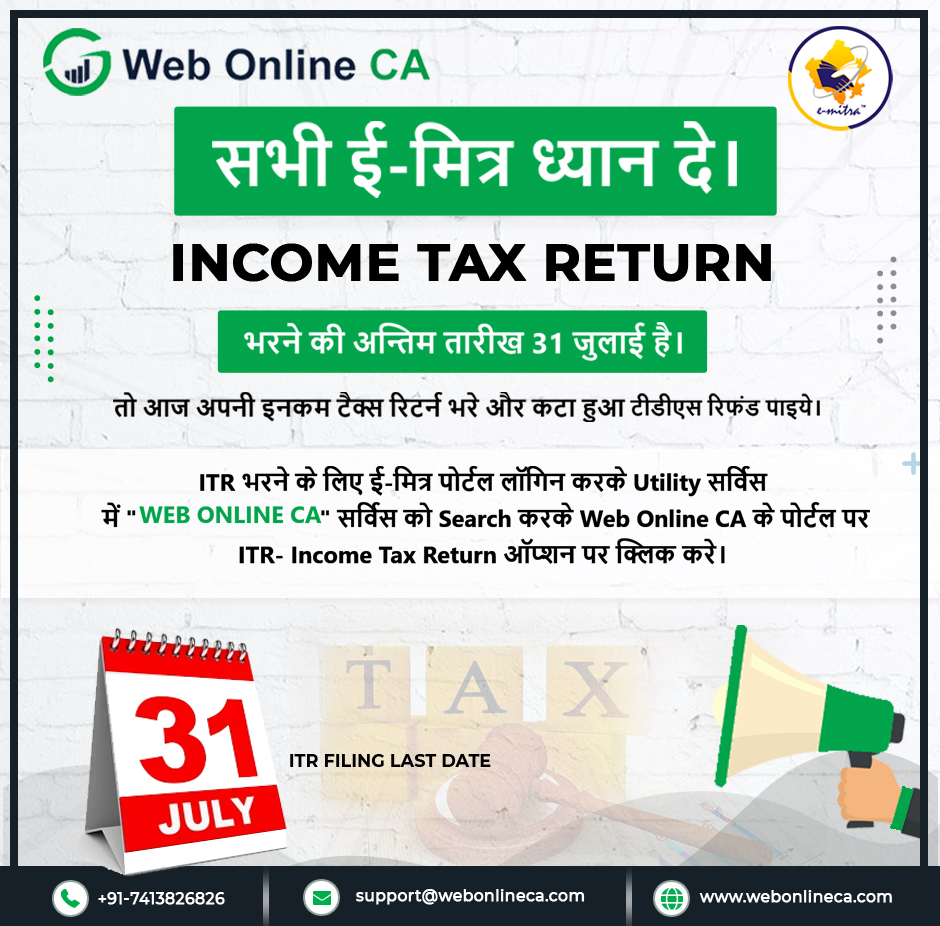

Conclusion

The GST portal is straightforward, so you won't

need help registering or downloading a GST certificate. It includes

comprehensive information on the various GST categories and the associated GST

returns. Visit the gst site to learn more and discover GST registration Near

me.